The GOP finally finds a good tax: on the poor

As bad as things are right now in Michigan, they are about to get so much worse that I fear there is a genuine risk of the types of riots we haven’t seen since the 60s & 70s in my state. If you think we have too many failing schools and too many failing cities now, if you think the disenfranchisement of our citizens through the imposition of Emergency Managers was at a shocking level in 2011, wait until you take a peek at what’s to come in 2012.

This is corporatocracy and war on the 99% writ large and writ bold.

Joanne Bump, a senior policy analyst with the Michigan League for Human Services has a terrifying new report out titled “Tax Changes Hit Low-Income Families the Hardest”. The report is HERE (pdf) with an Executive Summary HERE (pdf). I spent some quality time with this report and what I read was both compelling and terrifying. It’s an easy read and I highly commend your attention to it.

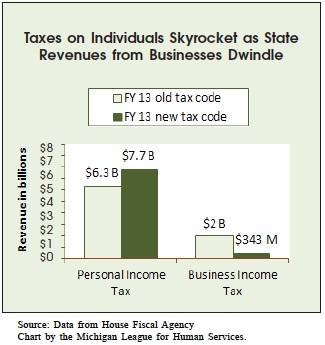

First of all, as we all know, last year the Michigan Republicans passed a budget that lowers business taxes by $1.6 billion and increases individual income taxes by $1.4 billion.

It looks like this:

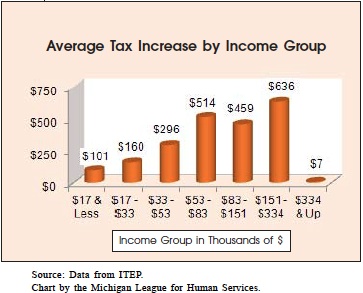

What is shocking is how easy the budget goes on upper income Michiganders and how astonishingly HARD it hits lower income residents. Take a look at the average tax increase broken down by income group:

In fact, when you look at the total state and local taxes as a percentage of income of those making $334,000 or more per year vs. those making $17,000 year or less, the poorest people pay 1000 times more than those at the top of the food chain. The poorest Michiganders pay 1.0% of their income vs. 0.001% for the top earners.

Other things from the report that you should know about the tax time bomb that explodes in Michigan in 2012:

- Despite continuous Republican screeching about “simplifying the tax code”, this new budget decidedly does NOT make it less complicated.

- Reduces the Earned Income Tax Credit (EITC) for the working poor from 20% to 6% of the federal credit – a 70% cut.

- Lowest 20% of income earners pay 9.1% of income in state & local taxes, top 1% pay only 5.6%.

- All major tax credits except the Homestead Property Tax Credit are now gone. Donations to food banks, shelters, and food kitchens: gone. Donations to charities: gone.

- Taxes are instituted or increased on private and public pensions for certain groups of senior citizens/retirees.

- Deduction for children in the family has been eliminated.

- Homestead Property Tax Credit (HPTC) has been taken away for over a quarter million Michiganders with incomes between $50,000 and $82,650. Seniors with incomes between $30,000 & $50,000 will have this credit reduced by 40%. Only half of the working poor that qualify for the EITC will also qualify for the HPTC.

At the end of the day, here’s a very important thing to remember: Thanks to the new Republican budget, 51% of all Michigan tax payer will pay MORE in personal income taxes in 2012 and beyond. Read that again. Over HALF of Michiganders will pay MORE TAXES because of the Republican budget. This is not Democrats. This is not even the Republicans of yesterday. This is, in fact, a mostly tea party-driven legislature who came in on a small government, less taxes bandwagon, tooting horns and banging tambourines.

And they just raised taxes on over half of our residents. Oh, yeah, and that whole smaller government thing? Republicans passed an unprecedented 323 laws in Michigan last year. Think about that.

One more thing: the reason they give for this sweeping change is that it will stimulate new business growth in our state. But let’s face it, that growth and that economic improvement is not meant for our poorest cities. No business looking to set up shop in Michigan is going to put their business in a city that has a failing government, crumbling infrastructure, poor amenities and underfunded, bankrupt schools. They aren’t. It’s obvious. They will go directly to the newer, more upscale suburban areas to do business.

In other words, the economic growth that this new tax paradigm is supposed to solve Michigan’s problems will do nothing of the sort. Places like Flint and Pontiac and Detroit and Benton Harbor and Ecorse and Highland Park will NOT see the boom that Republicans believe is coming; they will NOT participate in any meaningful way in our impending economic recovery should it ever arrive, not any time soon. These cities will continue to struggle and fail because we have done nothing to invest in their futures. We have done nothing to make them attractive to businesses or to anyone that might wish to relocate.

And, don’t forget: at the same time Michigan Republicans did all this to our tax codes, they stripped a billion dollars out of our statewide school system. Most of the impacts of that have yet to hit so if you think the imposition of Emergency Managers in our school systems is out of control NOW, wait until next fall. If you are a union member that works for a school district, you are seriously at risk of losing anything resembling a decent wage once the anti-union Republicans are done with you this year.

If you think that things were bad for the poor in 2011 in Michigan, you ain’t seen nuthin yet. 2012 is where shit gets real.