How do you build a city up armed only with implements of destruction?

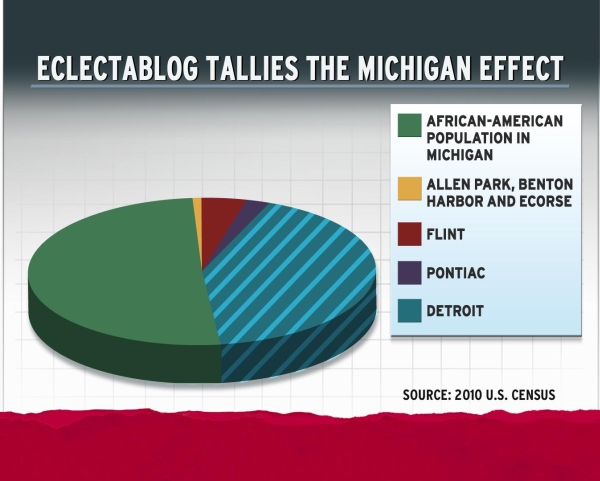

This afternoon, Governor Rick Snyder announced that he will appoint an Emergency Financial Manager for Detroit calling it a “sad day” that he wished “had never happened in the history of Detroit”. As I have already detailed in a post that has been cited by MSNBC and Huffington Post among others, this will result in 49% of the African Americans in Michigan being without a democratically-elected government.

Here’s my now-famous chart once again (with the African American population in Michigan updated to the correct 14.3% figure):

| City | Population | % African American | # of African Americans |

| Allen Park | 27,921 | 2.1% | 586 |

| Benton Harbor | 10,047 | 89.2% | 8,962 |

| Detroit | 706,585 | 82.7% | 584,346 |

| Ecorse | 9,414 | 46.4% | 4,368 |

| Flint | 101,558 | 56.6% | 57,482 |

| Pontiac | 59,887 | 52.1% | 31,201 |

| Total | — | — | 686,945 |

| Michigan | 9,876,801 | 14.3% | 1,412,383 |

[Source: U.S. Census Bureau]

Here’s what that looks like graphically in this chart graciously provided by my good friends at They Rachel Maddow Show from their coverage last week:

Rev. D. Alexander Bullock issued a warning today:

Today’s announcement will add to the growing tension in Michigan. We wait to see if austerity will trump democracy and prosperity. Emergency management has not been tried on a city the size of Detroit in Michigan. The experiences of Benton Harbor and Pontiac don’t provide a good basis for arguing for the success of emergency management in Detroit. Today, we continue to push to protect our voting rights and demand a sustainable holistic reinvestment approach to solve Detroit’s problem.

Krystal Crittendon, candidate for Detroit mayor, put out a press release earlier this week suggesting the Financial Review Team has reported wildly inflated numbers. It is her contention that Detroit is not in nearly as bad shape as the Governor’s team reported:

The Financial Review Team’s findings in their report concerning the City of Detroit’s financial status should come as no surprise to anyone. The bottom line: the Report provides no justification for the appointment of an emergency financial manager, especially when it makes no mention of $800 million in accounts receivable owed to the City as confirmed by State Treasurer Andy Dillon.

Crittendon, the former Corporation Counsel for the City of Detroit Law Department released another statement today that said, in part:

I urge the Governor to consider the many flaws and inaccuracies contained in the Financial Review Team’s report.The validity of the EFM and EM laws notwithstanding, I am glad to know now that we have been joined by other civic leaders who agree with our assessment, that if the City were to collect the money it is owed by private corporations and by the State of Michigan, there would be no economic crisis.

We continue to ask for transparency in the resolution of this fiscal matter. We need to have a full review of everything which is owed to the City, as well as everything that the City must pay.

Lisa Howze, another candidate for mayor, concurs:

[T]he state of Michigan’s review team amplified Detroit’s financial obligations by nearly 13 billion dollars. This amount principally includes 6 billion dollars in water and sewage revenue bonds; 5 billion dollars in other post-employment benefit costs accelerated by 25 years; and, 1.5 billion dollars in pension obligation certificates that have an offsetting asset for virtually the same amount.After a three-month review of the city’s financial reports, Howze and [CPA Randy] Lane presented how the city’s audited financial statements show long-term financial obligations at 2.1 billion dollars. “Debt is not something we fear. Debt is something we manage. The water and sewage revenue bonds are covered by water rate payers and are not at-risk of default,” said Howze during today’s press conference. Lane added that, “Revenues in the water department reached a record 800 million dollars in fiscal year 2012.”

According to Howze, “The reported long-term financial obligations of 2.1 billion dollars comprised principally of $1.1 billion dollars in interest-bearing debt and another 620 million dollars in obligations for retiree health care costs are manageable. There is no need for a state-appointed emergency manager.

A third mayoral candidate, Sheriff Benny Napoleon, agrees as well. He issued a statement today saying, “I also have serious questions about the veracity of the state review team’s report that appears to have overstated the city’s long-term debt, a question the Governor failed addressed in his news conference.”

I’m not an expert or a CPA so I can’t comment on the veracity of the claims of these candidates (though I’ll confess I am a bit skeptical.) What I will say is that I still believe a managed bankruptcy is a far better option for Detroit. It’s one that allows elected officials to remain in power and takes the politics out of the equation. I also believe that the solution to Detroit’s problems will not come at the hand of a single person who has only tools for cutting and slashing in their arsenal. Until Michigan gets serious about real urban renewal in our failing urban centers, the downward spiral into gentrification will stop only when everyone that can has left Detroit. Then, developers and businesses will swoop in to pick the carcass to pieces then exploit these cities for their own personal profit. It truly is the only foreseeable endgame unless something is done to revitalize them.

However, what I or anyone else thinks matters little because, at the end of the day, it’s up to Governor Rick Snyder. He is the one that has all of the power.