It is difficult to get Paul Ryan to understand something, when his career depends upon his not understanding it

After the worst stock market crash in history, Herbert Hoover decided that more than anything the budget needed to be balanced with cuts and tax increases.

After the worst stock market crash in history, Herbert Hoover decided that more than anything the budget needed to be balanced with cuts and tax increases.

Now, this was a very popular belief at the time.

His opponent Franklin Delano Roosevelt ran on the same promise and immediately it abandoned it when he came into office.

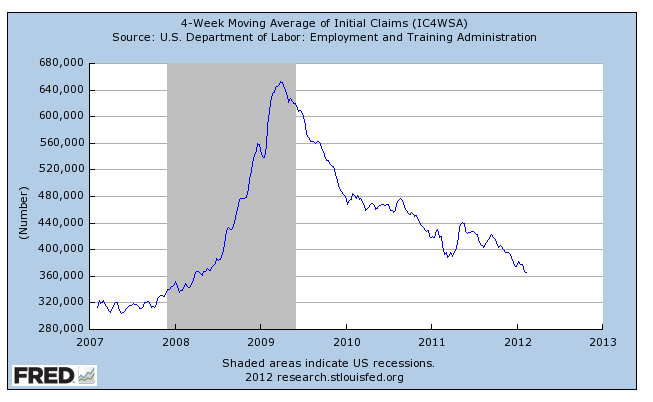

We know that the government has to spend when the economy is in crisis because that’s what reversed then ended the Great Depression and that’s what reversed that layoff crisis that President Obama inherited.

(Hmmm what happened in the second half of 2009? Right, the Stimulus went into effect.)

We know that trying to balance the budget when the economy is weak only leads to more debt and unemployment. We know this because of what Hoover did and what’s happening right now in Europe.

We know the best thing to do right now is to spend more and not raise taxes.

I know this and I’m still for ending tax breaks on the richest and corporations. I favor this because I believe inequality is our greatest long-term economic problem. So I like to pretend that raising taxes on the rich might lead to an economic boom, as it did in the 90s.

I also suggest ending tax breaks on the rich because I’m a clown that lives to point out GOP hypocrisy and there’s no greater hypocrisy than self-proclaimed deficit hawks cutting aid to the poor, the elderly and veterans while millionaire fund hedge managers pay lower tax rates than nurses.

Paul Ryan is a clown, too.

But he’s the kind of clown gets taken seriously by the billionaires who fund the GOP — and love his belief that tax cuts cure everything but baldness — and thus the media generally reveres him too.

Ryan, of course, doesn’t care what’s best for the economy right now; his belief is the government is making people lazy.

Thus the government has to spend and tax less than it did during the 60s before Medicare, before the Baby Boomers retired. It’s a clownish belief that he substantiated with an academic study that said that countries with debt higher than 90% of their GDP experience much slower growth. The study’s authors have said they weren’t suggesting the causation. The debt could be causing the slow growth or vice versa.

But Ryan used the study to make his case for more cuts now, which would lead to more debt anyway.

Now it turns out that the study Ryan relied on is likely fundamentally flawed.

This is thrilling Ryan’s critics and those who know the basic formula to get out of an economic crisis is put people to work. But will it change Paul Ryan’s mind?

You can stop laughing now.