They think you’re stupid and gullible. Don’t prove them right.

In February of 2012, I penned a piece titled “The tax timebomb that explodes in Michigan in 2012 is MUCH worse than you thought”. In it, I showed how Michigan Republicans raised taxes on over half of the people in our state. Worse than that, the brunt of the tax hit was borne by those at the lower end of the economic scale including our seniors.

In February of 2012, I penned a piece titled “The tax timebomb that explodes in Michigan in 2012 is MUCH worse than you thought”. In it, I showed how Michigan Republicans raised taxes on over half of the people in our state. Worse than that, the brunt of the tax hit was borne by those at the lower end of the economic scale including our seniors.

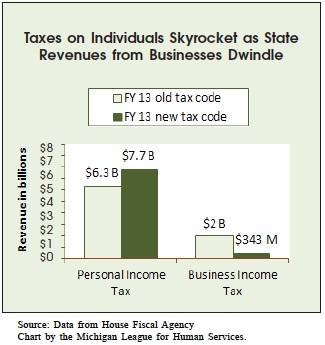

My piece was based on a report by the Michigan League for Human Services (pdf) that had a couple of very telling charts in it.

Like this one that shows how business taxes plummeted by over $1.6 billion while personal income taxes went up by $1.4 billion:

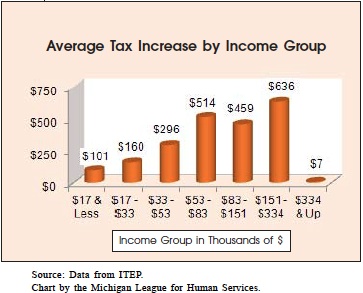

There was also this one that shows the disparate impact on the poor:

[W]hen you look at the total state and local taxes as a percentage of income of those making $334,000 or more per year vs. those making $17,000 year or less, the poorest people pay 1000 times more than those at the top of the food chain. The poorest Michiganders pay 1.0% of their income vs. 0.001% for the top earners.Other things from the report that you should know about the tax time bomb that explodes in Michigan in 2012:

- Despite continuous Republican screeching about “simplifying the tax code”, this new budget decidedly does NOT make it less complicated.

- Reduces the Earned Income Tax Credit (EITC) for the working poor from 20% to 6% of the federal credit – a 70% cut.

- Lowest 20% of income earners pay 9.1% of income in state & local taxes, top 1% pay only 5.6%.

- All major tax credits except the Homestead Property Tax Credit are now gone. Donations to food banks, shelters, and food kitchens: gone. Donations to charities: gone.

- Taxes are instituted or increased on private and public pensions for certain groups of senior citizens/retirees.

- Deduction for children in the family has been eliminated.

- Homestead Property Tax Credit (HPTC) has been taken away for over a quarter million Michiganders with incomes between $50,000 and $82,650. Seniors with incomes between $30,000 & $50,000 will have this credit reduced by 40%. Only half of the working poor that qualify for the EITC will also qualify for the HPTC.

At the end of the day, here’s a very important thing to remember: Thanks to the new Republican budget, 51% of all Michigan tax payer will pay MORE in personal income taxes in 2012 and beyond. Read that again. Over HALF of Michiganders will pay MORE TAXES because of the Republican budget. This is not Democrats. This is not even the Republicans of yesterday. This is, in fact, a mostly tea party-driven legislature who came in on a small government, less taxes bandwagon, tooting horns and banging tambourines.

The average tax hike on Michigan residents by the Republicans in their first year in office after the 2010 wave election was 23%. The spring before the 2012 election, they decided, in a act of benevolence only a true corporatist could love, to give back a bit and cut personal income taxes. By how much?

0.1%.

Heading into 2014 the state government, not surprisingly, finds itself with a budget surplus of $1.3 billion, almost exactly the amount they took from Michigan residents their first year. And, since it’s an election year, guess what? Yup, they’re talking tax cuts.

Michigan residents could be in line for an election-year tax cut, as the Senate Fiscal Agency estimates the state’s revenue picture has brightened by close to $1.3 billion over three years.House Speaker Jase Bolger, R-Marshall, said the money belongs to taxpayers, not the state government, and lawmakers should look at tax relief ahead of any spending plans. He wouldn’t specify any tax cut plans, except to say cuts should be broad-based and benefit individuals as opposed to corporations.

Bolger said he wanted to first discuss the issue further with his caucus. Lawmakers return to the Capitol on Wednesday from their holiday break.

“I believe the House Republicans will look for tax cuts as we see signs our economy is improving,” Bolger said in a recent interview.

“We are talking about personal tax relief,” he said, listing investment in early childhood development and improving Michigan roads as other top priorities.

It’s interesting that Speaker Bolger thinks “the money belongs to the taxpayers” after he and his crew took that money — almost to the dollar — from taxpayers in the first place. In an election year when they will be slammed every way from Sunday for screwing over the middle class and the poor in our state, this pandering move is nothing more than a ploy to buy votes. They don’t need to give corporations tax cuts; they’ve already done that to the tune of over $1.6 billion. But, I can guarantee you that the poor and middle class folks in our state will not be seeing tax rates restored to their original rates. No, the Republicans will pull their same “fake concession” BS and give just enough back that they can point to it and say, “Look, we cut your taxes!”

But you’ll still be in the hole.

Don’t count on them returning the whole thing to taxpayers. That’s not how they roll. They’ll return a tiny percentage of it and claim that they are tax cutters despite reality. It’s GOPocrisy, pure and simple.

Don’t let them fool you.