As the Republican Party inches around Marco Rubio, he’s getting the vetting his success has awarded him.

The press is looking into his personal finances, possible misuse of a Republican Party charge card, and his 80s-sitcom like dependence on a local billionaire.

But none of this could reveal anything more damning than what Marco Rubio is basing his entire candidacy upon — his offensively immoral tax plan.

Citizens for Tax Justice looked at his plan and found it would cost $11.8 TRILLION over the next ten years, with over a third – about $4 trillion – going to the richest 1 percent of Americans. This would “require draconian cuts to essential public services and likely wreck our economy.”

The richest Americans would get an average tax break of $220,000 for a total cost of $400 billion a year.

With just the money Rubio wants to give to the richest, you could fund Bernie Sanders’ plan for free college for all Americans more than five times over.

What would we get in exchange for gutting our economy to the point where the only thing we could afford are drone strikes on transgender people who try to use the proper restroom?

“It’s the same old trickle-down rap,” economist Jared Bernstein wrote in an excellent piece entitled “Marco Rubio’s tax plan gives a huge gift to the top 0.0003 percent.”

Bernstein notes that all the GOP candidates offer huge, basically insane tax cuts to the rich, but Rubio’s plan is amazingly slanted to his friends, the billionaires:

If you were thinking: “what tax change could I implement that would be most helpful to the wealthiest households?” you’d quickly come to the same conclusion as Rubio: zero out taxes on capital gains and dividends.

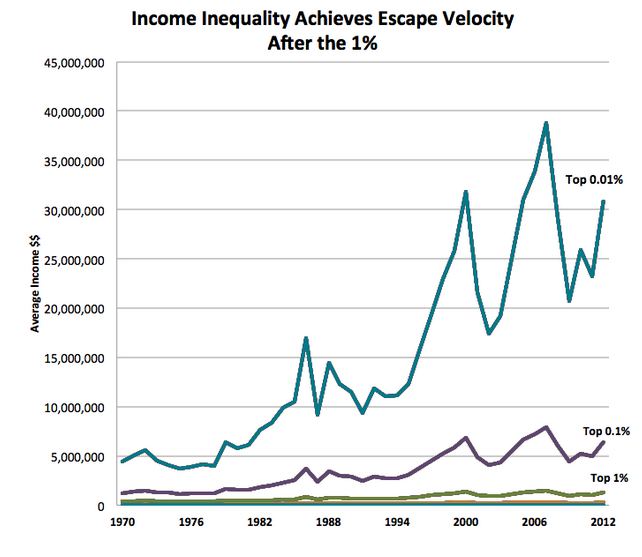

America’s greatest economic crisis is revealed in this chart:

The only significant income gains are being enjoyed by the richest Americans. The slight gains the rest of us have made have come from worker harder and longer.

The first glimmer of good news we’ve had when it comes to inequality is that it seems to have dropped sharply in 2013 — when we let most of the Bush tax breaks for the rich expire.

It’s nice that he wants to give trillions in tax breaks to non-rich people too. However, he would do so while raising the retirement age for Social Security, even though the people who have been most afflicted by the economy aren’t living longer, their just working more.

You’ve probably heard about the recent study from Anne Case and Angus Deaton that showed “a marked increase in the all-cause mortality of middle-aged white non-Hispanic men and women in the United States between 1999 and 2013.”

Why are white people dying in their middle age? One answer may be the lack of economic security.

“The United States has moved primarily to defined-contribution pension plans with associated stock market risk, whereas, in Europe, defined-benefit pensions are still the norm,” the authors note. “Future financial insecurity may weigh more heavily on US workers, if they perceive stock market risk harder to manage than earnings risk, or if they have contributed inadequately to defined-contribution plans.”

Taking away the one kernel of security workers have — a bare-bones retirement guarantee at the age of 67 — is the exact opposite of what we should be doing.

Instead we should be asking the people Rubio wants help most to invest a little bit more in the society that has given them so much to strengthen Social Security and expand it for the poorest.

Yes, Marco Rubio has a spending problem. He wants to spend your money to pay off billionaires while the least among us are worked to death.

Thanks, Sean McElwee — who you must follow on Twitter — for help with this post. He’ll be back on Eclectablog next week with more exclusive research.

[Photo by Gage Skidmore | Flickr ]