Protections remain in place to prevent trans-specific exclusions, so enroll before the January 31 deadline for 2017.

Let’s face it: There’s a lot of uncertainty right now about the future of the Affordable Care Act (ACA), or Obamacare, but that’s no reason for anyone to put off getting signed up for insurance in 2017. In fact, there is no better time to get covered, before 2017 enrollment ends on January 31 — particularly for transgender people.

Let’s face it: There’s a lot of uncertainty right now about the future of the Affordable Care Act (ACA), or Obamacare, but that’s no reason for anyone to put off getting signed up for insurance in 2017. In fact, there is no better time to get covered, before 2017 enrollment ends on January 31 — particularly for transgender people.

Last year, the U.S. Department of Health and Human Services (HHS) issued a final rule regarding Section 1557 of the ACA, protecting all people from discrimination in healthcare on the basis of race, color, national origin, age, disability and sex. This includes discrimination based on pregnancy, gender identity and sex stereotyping. The term “sex stereotyping” refers to the discriminatory idea that everyone should be heterosexual or conform to a particular gender norm. The rule applies to insurance plans in 2017 and beyond.

Despite a nationwide injunction blocking enforcement of the ban on gender identity-based discrimination on December 31, 2016 — a judicial decision that’s unlikely to go unchallenged — it remains the best year in history for transgender people to get health insurance, says Katie Keith, a steering committee member at Out2Enroll.

“Despite the injunction, being transgender is no longer a pre-existing condition,” she says. “You can still get a plan and 2017 plans are better than ever.”

Keith knows this to be true because Out2Enroll looked at 850 different Silver plans in 16 states, to find out whether or not 2017 plans sold through HealthCare.gov were actually in compliance with Section 1557. Here’s what they learned:

We were happy to see that the vast majority of plans we looked at had gotten rid of transgender exclusions. It was sort of a sea change in terms of getting rid of nasty language for transgender consumers. So this is the year to get covered.

To help transgender consumers find a plan that provides the broadest possible coverage for their individual needs — and identify the 20 percent of plans that had language indicating that all or some medically necessary transition-related care would be covered in the plan — Out2Enroll has released new state-specific Transgender Health Insurance Guides. The guides are a great starting point for transgender people shopping for insurance, because they provide a quick overview of options in each state, along with links to plan documents.

People in states for which there is no guide can email info@Out2Enroll.org for information. Out2Enroll encourages transgender consumers to work with a qualified enrollment assister, who can provide free, expert guidance in choosing the right plan. This is especially true because the guides only apply to transgender exclusions on Silver plans, and each person’s needs are unique. Also, plans may have other exclusions (such as cosmetic exclusions) that may impact coverage and not all insurers offer coverage in all areas of the state.

People in states for which there is no guide can email info@Out2Enroll.org for information. Out2Enroll encourages transgender consumers to work with a qualified enrollment assister, who can provide free, expert guidance in choosing the right plan. This is especially true because the guides only apply to transgender exclusions on Silver plans, and each person’s needs are unique. Also, plans may have other exclusions (such as cosmetic exclusions) that may impact coverage and not all insurers offer coverage in all areas of the state.

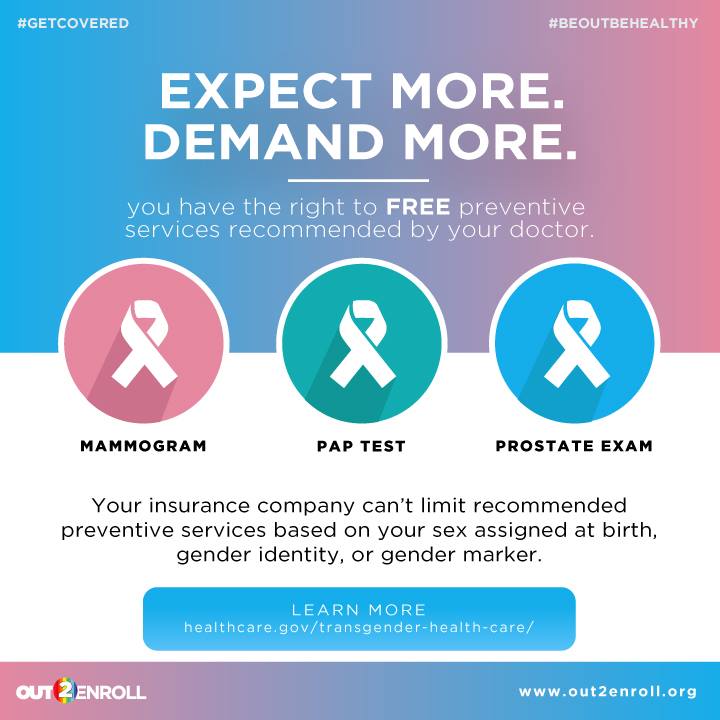

Once you have insurance, it’s important to make sure you’re getting the benefits and care to which you are entitled, adds Keith.

Our message is: expect more, demand more. We fully recognize that some transgender people will deal with setbacks. No one expects that everything is automatically covered. People are still going to have to advocate for themselves sometimes. But we can’t fight insurance company denials and discriminatory benefits if people aren’t insured in the first place.

There’s no time to wait: Open enrollment for 2017 ends on January 31. Take a look at the Transgender Health Insurance Guides and find free, local enrollment help from a trained assister today. You can also enroll at HealthCare.gov.

If your coverage is denied, file an appeal with your health insurer. If you face discrimination by an insurer or health provider, file a complaint with the HHS Office for Civil Rights. There are also legal organizations ready to help transgender people fight for the full equality they deserve.

[Images courtesy of Out2Enroll.]