Republican Congressman David Trott from Michigan’s 11th Congressional District has a long and sordid history profiting from the “human misery” caused when his foreclosure business threw victims of the Bush Recession out of their homes. He didn’t just run a foreclosure-based law firm. He created a vertically integrated machine to ensure that he got profit every step of the way:

Republican Congressman David Trott from Michigan’s 11th Congressional District has a long and sordid history profiting from the “human misery” caused when his foreclosure business threw victims of the Bush Recession out of their homes. He didn’t just run a foreclosure-based law firm. He created a vertically integrated machine to ensure that he got profit every step of the way:

CHRIS HAYES: What money is there to be made the process of [foreclosure]?

DAVID DAYEN: There’s not a whole lot of money to be made if you’re just doing the legal work. But Trott & Trott had a unique business strategy where they bought up practically every company down the line that gets a little bit of money out of the foreclosure process. There’s a requirement in Michigan that you have to put legal notices out in the newspaper. They bought the newspaper that did that. There’s a requirement that you have to do a title search. They bought the company that does the title searches and they get money off of that. They bought a real estate agency that then sells the houses after they go into foreclosure. So they kind of made money at every step down line and once you add that up, it’s lucrative.

HAYES: Yeah, they created, it’s sort of a “turnkey” foreclosure operation for the banks where they’re, basically, at every step in the line, they own it.

In 2007, during the height of the housing crisis in this country, Trott went on record as being a BIG fan of the very same subprime mortgages that led to so many of the foreclosures he cashed in on. And why not? It just meant more profit for the multi-millionaire.

Well, now that he’s in office, Trott is working to enrich himself through his foreclosure business even more. This week he introduced H.R. 1849 – the “Practice of Law Technical Clarification Act of 2017”. This is a bill that, if signed into law, would exempt law firms and licensed attorneys (like Trott’s business Trott & Trott) who are engaged in debt collection from consumer protection regulations and oversight. Here’s the description of what the bill does:

To amend the Fair Debt Collection Practices Act to exclude law firms and licensed attorneys who are engaged in activities related to legal proceedings from the definition of a debt collector, to amend the Consumer Financial Protection Act of 2010 to prevent the Bureau of Consumer Financial Protection from exercising supervisory or enforcement authority with respect to attorneys when undertaking certain actions related to legal proceedings, and for other purposes.

In other words, Trott’s firm could go about its shady business of capitalizing off the financial hardship of families and turn a tidy profit without the nuisance of oversight from the Consumer Financial Protection Bureau getting in the way.

Canton resident Cori Carr expressed her disgust, saying, “Congressman Trott’s use of his official office to financially benefit his family’s foreclosure company is the reason why people don’t trust career politicians in Washington. We elected him to represent us, not to financially benefit his family’s foreclosure company. Why isn’t Congressman Trott working on protecting our healthcare, creating better paying jobs or responding to the concerns of his constituents? Instead, he appears to be more interested in benefiting his family financially. This is an attempt to rig the system in his favor and we demand that he withdrawal this proposal immediately.”

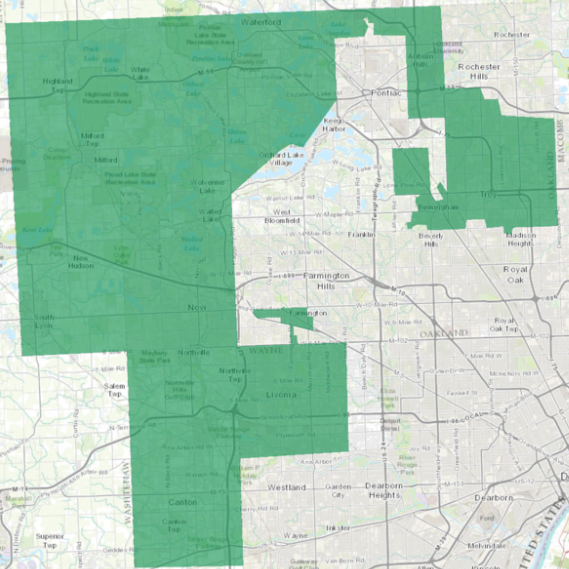

Trott won’t do that, of course. He’s in a safely gerrymandered district meaning he’s unlikely to be held accountable for his self-dealing and profiting from his own legislation.

How gerrymandered is the 11th Congressional District? Have a look for yourself:

It was very obviously drawn to make sure that the Democratic voters in Pontiac aren’t anything he has to worry about. However, given the rising awareness of voters in the 11th District and the possible challenge of a dynamic young millennial named Haley Stevens, Trott may have more to worry about from his constituents (many of whom Trott’s staff call “un-American”) than he thinks.