Attempting to deceive senior citizens is, simply put, sick and disgusting.

Governor Snyder is summoning his inner Obi Wan Kenobi, using the Jedi Mind Trick to try to convince seniors that he’s not taxing their pensions. “I want to be proactive, ” he said, “and let people know it’s NOT a pension tax. What we did was clean up our tax code.”

In other words, “These are not the senior pension taxes you’re looking for.”

Here’s the video:

Now, one of the things I wanted to talk about and this is, again, has been something that would be good to clear the air, this is about the reinvention of Michigan. It’s a topic that comes up quite often and it’s the quote unquote “pension tax”. And I want to be proactive and let people know it’s NOT a pension tax. What we did was clean up our tax code. We eliminated exemptions, exclusions, ways people weren’t paying tax. And one of those was for pension income. And why did we do that? It wasn’t to cause issues with people but it was unfair.The first thing we did, though, was we grandfathered everyone 67 and older. So, everyone that was a senior, 67 and older, when we did this change had no change to their situation. None in terms of the change for pension exclusion. What was to say, “You shouldn’t pay tax simply because you have a certain type of retirement income.” We are concerned about our seniors so said, “Let’s change that and create a different exemption that is to cover seniors.”

So, we took something that covered pension income, regardless of your age — if you retired in your 40s or 50s, it applied to you. Or if you have a very high income pension, it applied to you and you didn’t pay any tax. So, we replaced it with a senior exemption that’s being phased in. But for people 67 and older, that if you make $20,000 as a single or $40,000 — whether it’s pension income or you’re still working, that’s excluded from Michigan income tax. It makes us the 8th most generous state in the nation.

So, we got rid of something that’s fundamentally unfair in terms of high income people and people that were still working age but weren’t paying tax where people that were seniors that were working were still paying that tax. Now we’re making it fairer for seniors, whether you’re working or not, but if you have income, you can have an exclusion for that. If you’re a couple over $40,000, you shouldn’t pay any Michigan income tax – under $40,000, excuse me – you shouldn’t pay any Michigan income tax. That’s a good deal compared with most states.

So, that’s something that I just want to clear up with people because there’s been so much misinformation about it.

That’s a long-winded way of saying, “Yes, we’re taxing your pensions now.” He defends it because they instituted a “phased in” senior exemption. However, that exemption only applies to seniors who are barely above the poverty line or lower. If you make more than $20,000 in pension income as a single individual or $40,000 as a couple, everything above that level will continue to be taxed. Oh, and, by the way, that “senior exemption” doesn’t kick in until 2020 – six years from now. Details are HERE (pdf).

Governor Snyder is glib when he talks about this. After listening to it, you’d think that seniors should somehow be thanking him. But, as Tim Skubick pointed out when this all came down, he’s nothing more than a fast-talking CPA:

But his critics counter he did not bend far enough. They accuse him of providing a business tax cut to his cronies while taking $900 million from seniors and kids to do it.He’s not buying that and neither was he admitting that some citizens will pay more if lawmakers enact his budget.

“It’s not a pension tax, it’s removing a tax expenditure.”

Aren’t semantics great?

[…]

But will some persons pay more?

“This is not a net tax increase when you look at the numbers.”

This guy is good. If he doesn’t want to answer a question, he won’t.

A third, final and futile attempt on the “will some pay more” question.

“But it’s really based on the premise of a tax decrease creating an environment for job creation in the future.”

Parse the sentence and you find he sort of admits some will pay more when he refers to “it,” but give him credit, he never said it outright in that interview, but wonder of wonders, on a different exchange days later, he did confess, “It would be an additional tax burden.”

But it was interwoven into a longer answer and if you blinked your ears, you missed it.

In other words, Gov. Snyder is staking his entire approach on trickle-down economics, the idea that if we change policy to pump up corporate profit margins, everyone will benefit. It’s a theory that has been discredited so much that it’s almost a joke and nowhere more than here in Michigan. After three years of corporate welfare in the form of a $2 billion tax break for corporations — paid for largely on the backs of seniors and students — we still have the 44th highest unemployment rate in the country.

Don’t think that this is just some liberal blogger or Democratic candidate calling BS on the claim that Snyder hasn’t raised taxes on seniors. Even some Republicans are trying to reverse it:

A group of five Republican Senators last month introduced legislation designed to repeal the pension tax and fully restore homestead property tax credits cut in 2011. Democrats have regularly proposed similar ideas, most recently in the House caucus’ Michigan Middle Class Plan outlined last week.Republican Sen. Rick Jones of Grand Ledge, who introduced the repeal bill on March 20, said he did so in response to constituents in his district who have called his office or approached him in coffee shops to complain about the pension tax as they prepare their returns.

“Since it’s tax season, I’ve had a huge amount of calls from my constituents when they find out what their tax liability is,” Jones told MLive last month. “I think it’s extremely unfair when people have planned their life for their retirement and then suddenly, in the midst of their retirement, they get a new tax.”

So, senior citizens of Michigan, don’t be deceived by Gov. Snyder’s Jedi Mind Trick. These ARE the pension taxes you’re looking for and you likely ARE paying several thousand dollars a year more than you did before Gov. Snyder changed the rules. And he IS trying to fool you into believing this is somehow good for you, that’s it’s more “fair”. It’s not. The only people whose pensions won’t be taxed are those who are poorest. The rest of you can just suck it up and pay taxes on your pensions because, by Goddess, we have to cut corporate taxes.

Maybe, if you’re lucky, someday before you die, it will trickle down on you.

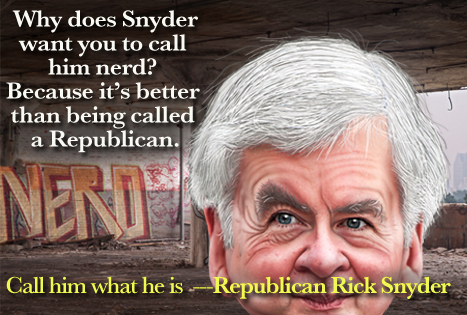

[Snyder caricature by DonkeyHotey from photos by Anne C. Savage for Eclectablog. Senior pension tax meme courtesy of the Michigan Democratic Party]