A new ad out by the Democratic Governors Association (DGA) calls out Michigan Governor Rick Snyder for raising taxes on Michigan senior citizens. It is the sixth ad run by the DGA in Michigan.

Here’s DGA Communications Director Danny Kanner:

Governor Snyder raised taxes on Michigan’s seniors to give tax cuts to the wealthy and buisnesses even if they shipped jobs overseas. Mark Schauer will reverse the Snyder retirement tax, restore Snyder’s devastating education cuts, and finally build a Michigan economy that works for the middle class, not just those at the very top.

This latest ad features a retiree from my neck of the woods in Scio Township, Rocky Gonet.

My name is Rocky Gonet. I’ve been retired about three years.I thought my retirement was safe.

Governor Snyder decided that he was going to tax my pension. He also raised property taxes on senior citizens.

Now I gotta scramble to make ends meet. I’ll be honest with ya, I’m scared. I don’t know what the future’s gonna hold.

He gave his business friends a nice tax break and he gave all us retirees a nice tax hike.

He’s taking care of somebody but he ain’t taking care of me.

Here are the facts:

Gov. Rick Snyder signed the biggest tax overhaul in Michigan in 17 years that finances the elimination of the Michigan business tax with a bundle of changes to the personal income tax.Overall, it amounts to a $220 million net cut in tax revenues to state coffers, but for Michigan businesses, including some 100,000 that no longer will have to pay the repealed Michigan Business Tax, it’s a $1.65 billion cut.

The difference is being made up with $1.42 billion in additional income taxes, which includes applying the tax to pensions and other retirement income.

“Something fundamentally had to happen to make us a great state again,” Snyder said before signing House Bill 4361 into law as Republican lawmakers looked on.

What “had to happen”, apparently, was to increase taxes on some of our most vulnerable Michigan residents.

In addition to taxing pensions for the first time, Gov. Snyder signed legislation into law that eliminates the homestead credit for an estimated quarter-million households. That’s a tax credit that many seniors used to help reduce their tax bill. So, even seniors without pensions are seeing their taxes go up thanks to Republican Rick Snyder.

And seniors aren’t the only ones who have taken a tax hit to benefit corporations. Here are other things that Gov. Snyder has done to raise taxes on over half the people in our state:

- Freeze the state income tax at 4.25 percent. It had been scheduled to fall to 3.9 percent by 2015. That was calculated by the House Fiscal Agency to raise $223 million in taxes in 2012-2013.

- Lower deductions for pensions for those born 1946 or after, adding an estimated $343 million in taxes.

- Reduce low-income tax credits from 20 percent to 6 percent, adding $261 million in taxes.

- Lower homestead property tax credits, raising taxes by $270 million.

Even our poorest residents are impacted.

As Rocky says, Rick Snyder is taking care of somebody but he ain’t taking care of YOU.

Rick Snyder tells us he’s making the “hard choices” that need to be made. But, at the end of the day, the people he is being hardest on are seniors, the poor, the LGBT community, workers, and women.

Remember that and make sure everyone you know knows it, too.

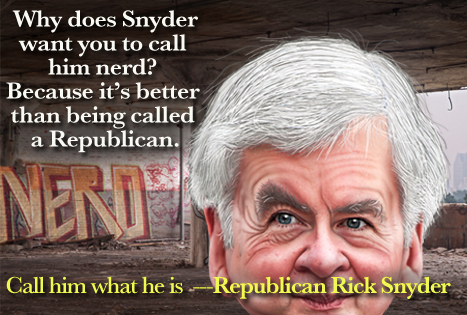

[Snyder caricature by DonkeyHotey from photos by Anne C. Savage for Eclectablog]