Why we all need to start talking about ‘runaway wealth accumulation by the richest’

Whenever there’s a debate about what we should be debating, somebody is usually hiding something.

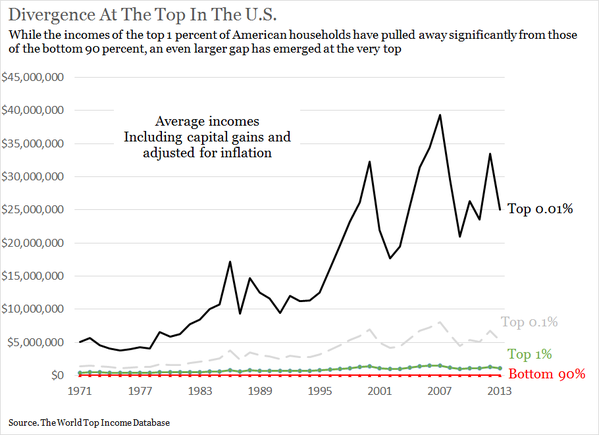

Everyone seems to agree that this chart is bad news is bad news for our kids:

But the question is how to frame it. Republicans want to talk about “mobility” or “the right to rise. In The Atlantic Jared Bernstein and Ben Speilberg make the case that you can’t deal with mobility without addressing inequality.

“Boosting mobility will require reductions in wage, income, and wealth inequalities,” they write.

“[Politicians] are much more comfortable focusing on the benign-sounding theme of ‘wealth creation’ or insisting that economic growth alone can improve mobility without any redistribution of resources or political power, as if ‘a rising tide can lift all boats’ matters when a few people are in yachts and many are stuck in dinghies.”

But it’s worse than that. A rising tide isn’t good news to someone who is overboard searching for a life jacket. And the richest don’t have yachts, they have battleships.

Even discussing “inequality” evades the real issue: The tide is rising for a small group of people so exorbitantly that it’s melting our ice caps, literally and figuratively.

The framing of the 1 percent was very useful but it actually understated the problem and obscured what’s really going on. Most of the richest 1 percent are in a similar situation as the remaining 99 percent in that they’ve seen little to no income growth over the last few decades because nearly all the gains are going to the very top .01 percent — about 16,000 people who are worth $110 million each.

David Cay Johnston puts the difference between the wealth of the top 1 percent and the richest .01 percent in perspective like this: “On average everybody else in the top 1 percent worked all year to earn what those 1,361 [richest] households earned every three days.”

Fixing this is necessary to fix our economy, our politics and our sanity.

“Inequality” sounds like an effort to drain anyone who is earning a decent living in order to redistribute to poor people who are smeared as lazy. In reality, the people pushing destructive redistribution are conservatives who want more money for the rich.

Marco Rubio wants to raise the retirement age of Social Security for the poor while cutting ALL taxes on investment, which are the only taxes most of the richest Americans pau. Chris Christie’s plan means test Social Security would be a massive tax increase on the middle class rather than a tiny increase on the rich that could sustain the program forever.

Inequality, the wage gap and a lack of mobility are all the symptoms of the same problem crisis: Runaway wealth accumulation by the wealthy, as George Lakoff explains his essential guide to framing Don’t Think of an Elephant.

(He uses “wealthy,” I say “richest” because it’s a bit finer point but he’s probably right given that he’s an award-winning Linguistics scholar and I’m blogging in my boxers.)

The merely rich in America — doctors and lawyers who earn less than a million dollars a year — feel threatened because they’ve become the new middle class. They feel the bleating envy of those below them toiling in corporate servitude and they pay HIGHER tax rates than richest who earn 100 times more than them.

That’s right. In an era where nearly all the gains of the economy are going to the very richest, the very richest pay lower taxes as they get richer. And in exchange for our generosity to the very richest, 4 out of 5 Americans saw their income shrink since the Bush capital gains tax cuts.

This occurs for the same reason that politicians are afraid to call it out: The richest .01 percent dominate our politics providing more than 40 percent of all campaign donations. Alienate them and they could destroy your career. Serve them and you’ll only become more valuable as a lobbyist.

The Walton Family owns as much wealth as 48.8 million families in America combined. This year Republicans are trying to eliminate the inheritance tax that the richest .02 of Americans pay so that all that wealth will be passed on whole. This is exactly the kind of dynastic transfer of wealth that threatens our entire economic system.

Ever wonder where the real vitriol and hatred for Obamacare comes from? Well, it raises taxes on the super rich to provide health care to the working poor. And the fact that it’s led to the lowest deficit and best job creation in years only makes destroying it even more important.

This kind of warping of our politics and economy only happen in a country that doesn’t understand the richest have never been richer. And they’re paying less in taxes than at any time since before America had a real middle class.

Politicians who want to win will be scared to say it. But once the realization of what’s going on hits America, it will be difficult for them to talk about anything else.

[Image by Hot Gossip Italia | Flickr. Chart courtesy of Mark Price.]