Cluck, cluck…

When Michigan Republicans took control of our legislature in 2010, they, along with our new Republican CEO Governor Rick Snyder, proceeded to enact a sweeping tax cut for corporations. It was all to bring new employers into the state which, in time, would lead to a more robust economy and a rising tide that would lift all boats. To pay for more than $1 billion in annual tax breaks for businesses, they cut school funding and raised taxes on the middle class and the elderly.

Those tax cut chickens have now come home to roost in the budget crater created by the corporate tax giveaway. As it turns out, the state of Michigan will, for the first time, be handing out more in corporate tax refunds than it is taking in in corporate taxes revenues. That’s right, corporations have now become a taxpayer-funded charity in Michigan:

Michigan corporations will see an overall income tax refund and effectively contribute nothing to the state coffers in 2016, according to new projections now forcing the Republican-led Legislature to cut back spending plans.

For the first time since GOP Gov. Rick Snyder spearheaded a major tax code rewrite in 2011, the state Treasury in 2016 is expected to pay out more in refunds under the old Michigan Business Tax than it will pull in under the new Corporate Income Tax.

Officials are projecting a net loss of $99 million in revenue from the state’s principal business taxes.

It’s terrible and, of course, entirely predictable. But that’s not the only story. As it turns out, tax revenues overall are down by nearly a half BILLION dollars this year, making the GOP’s budget crater nice and roomy for all those tax cut chickens:

The state of Michigan must cut $460 million from its 2016 and 2017 budgets under new revenue estimates released Tuesday, State Budget Director John Roberts said. […]

With big cuts needed Roberts said everything was on the table.

“I would say right now from our end everything’s on the table. We’re going to look at the Flint commitments very seriously,” Roberts said.

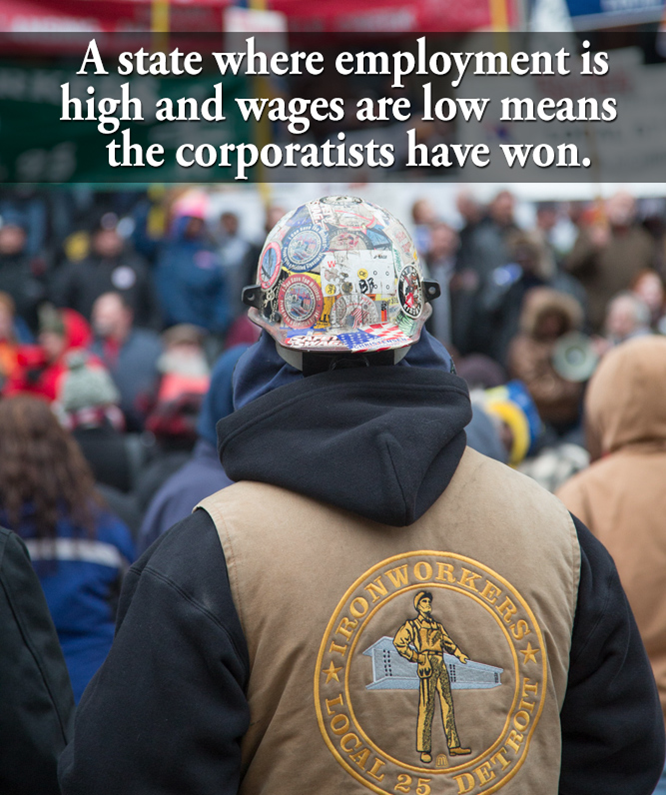

To add insult to injury, while the unemployment rate in Michigan is the lowest it has been since the Great Bush Recession, average family income in our state is lower now than it was eleven years ago (and ten years ago and nine years ago.) As I’ve said before, this is the corporatists’ dream: low wages coupled with high employment.

Oh, one more thing. THIS:

And though Michigan’s unemployment rate has dropped since he took office — a metric that likely has more to do with national trends than state tax policy — fewer jobs have been created every year since Snyder’s tax cuts took effect.

Last year, the bump was just 61,000 jobs, according to the Bureau of Labor Statistics. Four years ago, that number was 88,000.

Saying, “I told you so” doesn’t seem strong enough. Just remember all of this in November when every single state House seat is up for grabs.