Kicking cities while they’re down

Michigan Republicans passed a budget last year that gives businesses $1.6 billion dollars in tax breaks, paid for by slashing school funding and raising taxes on over half of Michiganders. Now, they are about to hand them another half billion dollars by phasing out the personal property tax (PPT).

It’s generally agreed that the PPT is not a particularly smart tax. It forces companies to pay taxes on equipment that they purchase which has the effect of encouraging them NOT to make capital investments that can help them thrive and grow.

However, here’s the rub: getting rid of it will take nearly half a billion dollars out of city budgets, many of which are largely dependent upon this tax. If you think the problem with bankrupt cities and Emergency Managers is bad now, this will make it worse.

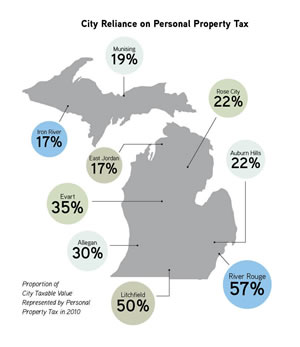

Have a look at this chart from the Michigan Municipal League (MML) Replace Don’t Erase website:

These are examples of cities where substantial amounts of their funding comes from the PPT. When I spoke with Dan Gilmartin from the MML about this last year, he put it this way:

Nobody likes the tax, however its elimination without a fully funded, guaranteed replacement would wreak havoc on municipalities throughout the state. Cities, villages, counties, schools —- you name it -— would suffer mightily if the PPT is eliminated without replacement. Bankruptcy would be the only option for literally dozens of local units. That’s why we have started the “Replace Don’t Erase” (www.replacedonterase.com) campaign, which is an effort to push for a full guaranteed replacement if the Legislature and governor choose to act.The argument that the PPT is anti-business has merit, but it is much more anti-business to attempt to attract people and jobs to a state that no longer funds its communities and schools at an adequate level. We will face this situation even more than we do today if a full, guaranteed replacement isn’t enacted. However, if the governor and Legislature enact a full, guaranteed replacement then the change could be win-win.

Eight bills, Senate Bills 1065 through 1072 have been introduced and a Senate hearing on them took place this week. One of the bills, S.B. 1072, has a scheme for replacing the funds through the expiration of other business tax breaks and via a “Personal Property Tax Reimbursement Fund”. However, it only replaces part of the lost revenues and puts returning the remainder off to a future legislature. MML’s Director of state affairs Summer Minnick calls it “TBD legislation” (To Be Announced.) Given the track record of this legislature with regards to fulfilling commitments made by prior legislatures, it’s no wonder they are concerned.

Business groups are, of course, giddy about this, a short-sighted view that doesn’t take into account that failing cities will drive businesses away from Michigan no matter how low taxes are here.

But while businesses love it, Michiganders aren’t so wild about it at all. An EPIC-MRA survey conducted on behalf of the Replace Don’t Erase coalition showed that:

- 70% of Michigan voters oppose (43% strongly oppose) eliminating or significantly cutting the personal property tax. In this question, voters were told the PPT pays for local services such as police and fire protection, schools, etc. They were also told that supporters of cutting the PPT say it will encourage businesses to invest more in machinery and equipment and create more jobs.

- Opposition to eliminating or significantly cutting the personal property tax increased to 78% once voters learned that cuts to local services (police, fire, schools, parks, libraries, and more) would likely result.

- Opposition to eliminating or significantly cutting the personal property tax also increased to 78% once voters learned that local property taxes would automatically increase in local communities with school districts that are repaying bonds with PPT revenues.

- 58% of voters said they would support (31% would oppose) a constitutional amendment to require the Legislature to fully replace all of the revenues and guarantee the funds continue to go to local communities and local schools.

- 59% of voters would be less likely (39% much less likely) to vote for their legislator in November if the legislator votes for a proposal that eliminates all or part of the PPT and fails to replace the funds with revenues that continue to go directly to local communities and schools.

Senate Majority Leader Randy Richardville defended the move saying:

We have to be competitive not only with Ohio, Indiana, Wisconsin, and other Midwest states, we also have

to be competitive with China and Mexico and anybody else we’re competing with on a global basis.

This “race to the bottom” competition worries some. Senate Minority Leader Gretchen Whitmer issued a statement saying:

This will amount to a $3 billion, when you add up this year and last year, gift to business’ bottom lines. And who’s paid for it every single time? Individuals. It’s another tax shift from businesses in Michigan onto the individuals. This is another step toward shifting taxes and this will require an increased tax on individuals in the state, one that I would submit we can’t afford. We need to know that Michigan is going to be a state where we can and will invest in our people and invest in an educated workforce.

It will be interesting to see where this goes. The fear I have, and it is a legitimate one, is that this will only increase the number of failing, bankrupt cities and further impositions of Emergency Managers around the state. If that happens, it will be an entirely manufactured crisis, courtesy of the Michigan Republicans. Richardville says he hopes to have it on the Senate floor in 3-4 weeks, before the legislature adjourns for the summer.